This article is a complement to Geopolitical Risks of Russian Oil Investment. It was written by contributor Jean-Pierre Desloges, CFA of http://www.financialiceberg.com.

Special Contributer: Jean-Pierre Desloges, CFA

Global Oil Supply Shock ?

Special Contributor to Global Trade Issues – Jean-Pierre Desloges, CFA

July 17 ( From EIA, MacroBusiness, The Barrell, IEA, WSJ, Atlanta Fed, CAPP, Wiki )

The Situation

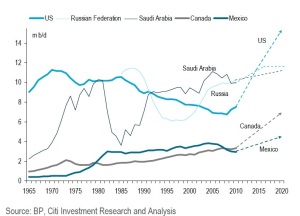

Following several years of stronger-than-expected North American supply growth, the shockwaves of rising United States (US) shale gas and light tight oil (LTO) and Canadian oil sands production are reaching virtually all recesses of the global oil market.

Following several years of stronger-than-expected North American supply growth, the shockwaves of rising United States (US) shale gas and light tight oil (LTO) and Canadian oil sands production are reaching virtually all recesses of the global oil market.

This North American supply revolution is not happening in a vacuum. Sustained high oil prices helped unleash it. Its impact is also compounded by other market developments, most prominently social and political turmoil in the Middle East and North Africa region in the wake of the ‘Arab Spring’ and the shift in demand to East-of-Suez markets.

Together, these powerful forces are redefining the way oil is being produced, processed, traded and consumed around the world. There is hardly any aspect of the global oil supply chain that will not undergo some measure of transformation over the next five years, with significant consequences for the global economy and oil security.

OIL: an Overview

For the first time this quarter, non-OECD economies will overtake OECD nations in oil demand (OECD: The Organisation for Economic Co-operation and Development).

At the same time, massive refinery capacity increases in non-OECD economies are accelerating a broad restructuring of the global refining industry and oil trading patterns.

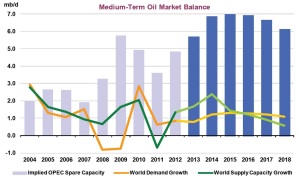

Take a look at the charts below to have a broad view of the world oil supply and demand…

While geopolitical risks abound, market fundamentals suggest a more comfortable global oil supply/demand balance over the next five years. The MTOMR (Medium-Term Oil Market Report) forecasts that North American supply to grow by 3.9 million barrels per day (mb/d) from 2012 to 2018, or nearly two-thirds of total forecast non-OPEC supply growth of 6 mb/d.

World liquid production capacity is expected to grow by 8.4 mb/d – significantly faster than demand – which is projected to expand by 6.9 mb/d. Global refining capacity will post even steeper growth, surging by 9.5 mb/d, led by China and the Middle East.

The Big Shift

The supply shock created by a surge in North American oil production will be as transformative to the market over the next five years as was the rise of Chinese demand over the last 15, the International Energy Agency (IEA) said in its annual MTOMR released lately. The shift will not only cause oil companies to overhaul their global investment strategies, but also reshape the way oil is transported, stored and refined.

According to the MTOMR, the effects of continued growth in North American supply – led by US light, tight oil (LTO) and Canadian oil sands – will cascade through the global oil market. Although shale oil development outside North America may not be a large-scale reality during the report’s five-year timeframe, the technologies responsible for the boom will increase production from mature, conventional fields, causing companies to reconsider investments in higher-risk areas.

The US at Play

Production

U.S. crude oil production increased to an average of 7.3 million bbl/d in April and May 2013, which is the highest level of production

since 1992. EIA forecasts U.S. total crude oil production will average 7.3 million bbl/d in 2013 and 8.1 million bbl/d in 2014.

So it is still surprising to read reports about how the American shale boom is set to push the US ahead of Saudi Arabia as the top producer globally by 2017.

Consequences of the Big Shift

More Stable Oil Prices

Growing North American oil supplies promise to bolster U.S. energy security, but they are already helping deliver a more global benefit: stable oil prices. Crude oil prices have remained remarkably stable over the past year in the face of a long list of supply uncertainties.

The new supply isn’t yet pushing prices lower, and analysts differ over whether it will but it is acting as a shock absorber in a global supply chain that pumps 88 million barrels of oil to consumers each day.

Less Vulnerability

The increasing U.S. energy supply helps reduce our vulnerability to global supply disruptions and price shocks, and thus affords us a stronger hand in pursuing and implementing our international security goals.

The new North American oil production has also reduced U.S. imports from OPEC members, which in effect gives OPEC more spare capacity. This gives the United States the ability to implement policies that will give the American people more security, and less dependence.

This chart helps demonstrate how quickly the oil landscape in the United States has indeed changed. The U.S. Energy Information Administration (EIA) expects national crude oil production to exceed net oil imports later this year, marking a rapid turnaround from the trend of ever-increasing reliance on imports.

The growth in North American oil production will change the balance in the oil industry With large-scale North American crude imports tapering off and with excess US refining output looking for markets, the domino effects from this new supply will continue.

Having helped offset record supply disruptions in 2012, North American supply is expected to continue to compensate for declines and delays elsewhere, but only if necessary infrastructure is put in place. Failing that, bottlenecks could pressure prices lower and slow development.

Oil Produce where it is Needed the Most

Another distinctive trait of the North American supply boom is that it is taking place at the heart of one of the world’s most highly industrialised, mature economies. The emergence of large-scale new supply in such a context will necessarily play out very differently from the way in which a comparable increase might affect the market if it came from a Middle East or sub-Saharan producer.

The Canadian Big Shift

Production

Canadian oil production continues to grow and although oil sands remains the largest component of growth, the resurgence of conventional crude oil production represents the largest year over year change to the previous forecast.

In 2012, total Canadian production increased from 2011 levels by 223,000 b/d to over 3.2 million b/d and continued growth is forecast in the long term. Eastern Canada produced about 6 per cent, or 202,000 b/d of the total Canadian crude oil production. Western Canada

produced 3.0 million b/d from combined conventional and oil sands production.

See the table below for the forecast for total Canadian production divided between eastern and western Canada.

Conventional production from western Canada is expected to remain fairly constant at around 1.4 million b/d throughout the outlook period while production from the oil sands is expected to grow from 1.8 million b/d today to 5.2 million b/d at the end of the forecast period. It is this growth from oil sands production that drives the overall increase in current production levels from 3.2 million b/d to 6.7 million b/d in 2030.

And the chart below shows the total Canadian production forecast til 2030…

The Russian Big Shift

Production

Russia is the world’s biggest oil producer and has been for quite a while.

In 2012, Russian oil production averaged 10.4 million b/d. Saudi Aramco, in its annual report published last week, said it pumped 9.5 million b/d last year. Russia’s place at the top of the oil producing league, then, seems assured, at least for now.

In May 2013, the average daily output hit a new 2013 high of almost 10.5 million b/d.

New Fields

New fields are being developed in East Siberia like the Vankor field who was discovered in 1988: Vankor is almost single-handedly keeping Russian oil production above 10 million b/d, helped along by a string of other new fields in East Siberia.

Covering a vast area of some 447 sq km, Vankor is astonishing. It holds an estimated 3.8 billion barrels of reserves, making it one of the world’s biggest oil fields and the largest to be discovered and brought online in Russia in the last 25 years. It can produce at more than 500,000 b/d: at $100/b oil, Vankor production is worth a staggering $50 million each day, or calculated over a year, a colossal $18.3 billion. By the end of 2012, the total number of production wells in operation at Vankor was 237, a giant operation by any standards.

Another notable field in East Siberia is Talakan, operated by Russia’s third biggest oil producer Surgutneftegaz.

The ESPO Pipeline

What changed was the fact that the construction of one of Russia’s biggest ever engineering initiatives: the East Siberia-Pacific Ocean ( ESPO ) export pipeline brang the possibility to bring new oil discoveries to markets.

Born out of a Yukos plan from 2001, work on EPSO began in 2006. Now a fully functioning export route with a capacity of almost

1 million b/d, ESPO has changed the dynamics not only of Russian oil production and exports, but oil supply across the Asia-Pacific region. Russian crude could account for up to 10% of total Japanese imports in 2013, for example.

Moscow also has ambitions to turn the ESPO oil blend–effectively the oil exported through the ESPO line–into a new global oil benchmark. For this to happen, production will need to increase further though, and the doubters don’t see East Siberia being able to achieve this at a fast enough pace.

In addition, a growing portion of ESPO output will need to be diverted to domestic refineries to make up for the falling production in West Siberia.

Conclusion

“North America has set off a supply shock that is sending ripples throughout the world,” said IEA Executive Director Maria van der Hoeven. “The good news is that this is helping to ease a market that was relatively tight for several years. The technology that unlocked the bonanza in places like North Dakota can and will be applied elsewhere, potentially leading to a broad reassessment of reserves. But as companies rethink their strategies, and as emerging economies become the leading players in the refining and demand sectors, not everyone will be a winner.”

And while the United States is seeing growing oil supplies and moderating demand, a different trend is taking place globally, with rising demand from China and other emerging economies coupled with declining supply from older fields and OPEC efforts to keep prices higher through production limits.

The shifting energy balance as a result of rapidly growing oil production from North America, Canada and Russia is acting as a shock absorber in a global supply chain that pumps 88 million barrels of oil to consumers each day. That helps everyone from manufacturers to motorists, and it bring therefore less economic volatility.

The other factor that should be taken seriously is the fact that Russia is the world’s biggest oil producer and has been for quite a while.

But political stability there can become an issue going forward…

That’s why the major change, I mean the emergence of large-scale new supply in such a context in the US where oil is produce where it is needed the most will necessarily play out very differently and bring some stabilization in the most volatile commodity market…

ABOUT Jean-Pierre Desloges, CFA

Visit http://www.financialiceberg.com/

Is a professional investment consultant/ blogger/ trader with over 25 years of experience working on the buy and sell-side. He has researched and invested in traditional and alternative asset classes and worked at Pensions Funds, International Banks and Dealers. Financial Iceberg started out in Oct 12′ as a way for him to share thorough research, provide trade ideas, and keep a trading journal that kept him accountable and systematic in his trading. The blog is about markets, economics, finance, and trading. He provides quick overviews of his market-related insights and thoughts as events unfold and point you toward other interesting content around the web that grabbed his attention.

Disclaimer: All views described herein are both author’s own and, as usual, any financial or investment advice is ‘use at your own risk’.

Categories: Trade News